Claim Your Employee Retention Benefit

Claim Your Employee Retention Benefit to maximize your financial incentives and support your workforce. This credit helps businesses retain employees during challenging times, offering valuable financial relief and stability for both employers and employees alike.

Recognizing Employers for Employee Retention

Recognizing Employers for Employee Retention entails acknowledging and rewarding businesses that prioritize retaining their workforce. By valuing employee tenure and commitment, these employers contribute to a stable and supportive work environment, fostering loyalty and productivity among their staff.

We're not just another firm churning out ERC claims! Amidst a sea of non-CPA entities rushing to file Employee Retention Tax Credit claims, we stand apart. Many of these newcomers lack the expertise, depth, and ethical standards needed to ensure accurate filing. We partner with trusted companies, guaranteeing your ERC claim's integrity and audit support.

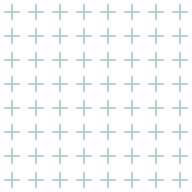

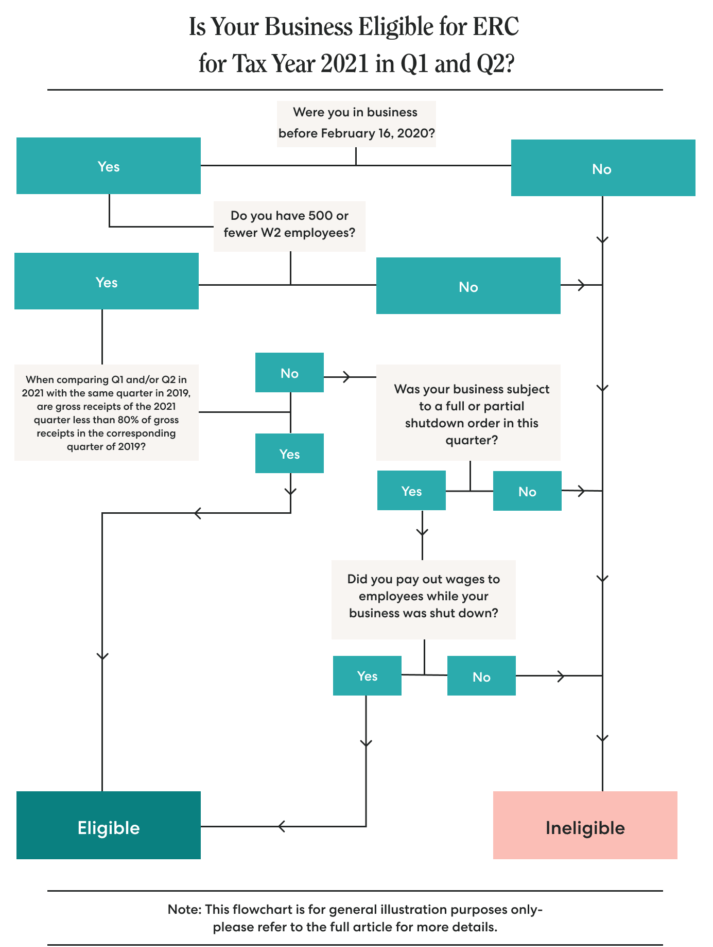

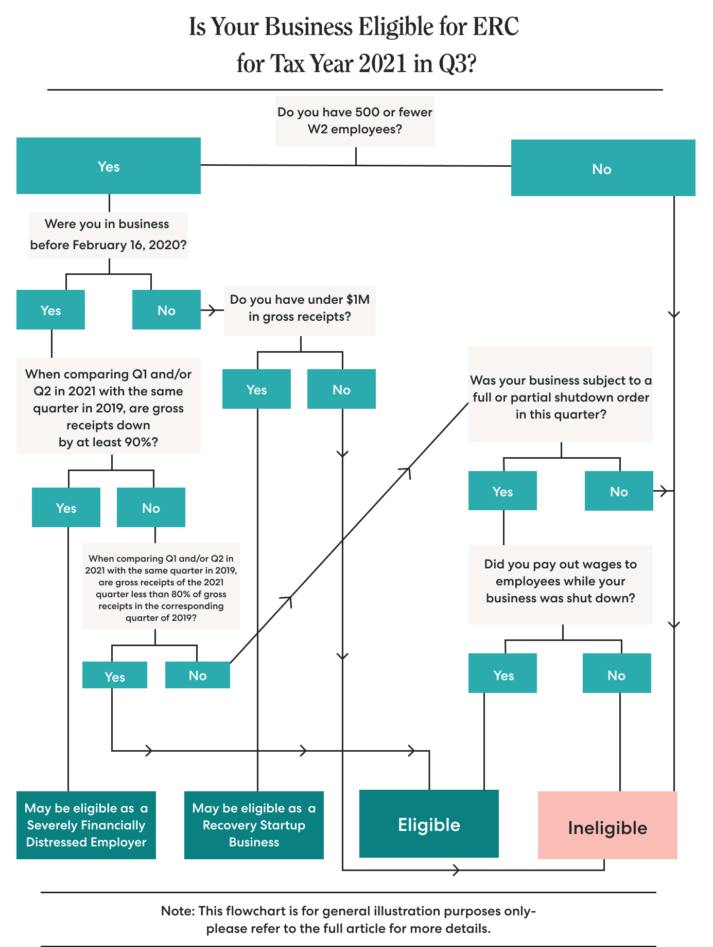

What Are the Conditions for Qualification?

Qualification Conditions: Essential criteria to meet for eligibility for the Employee Retention Credit (ERC).

Check Your Business's Eligibility for ERC in the Tax Year

Ensure You Meet the Deadline

To apply for an Employee Retention Credit for 2020, the deadline is

April 15, 2024,

and for 2021, it's April 15, 2025.

What Amount Can I Receive?

How much can you receive? The amount you're eligible to receive depends on various factors, including your business's size, the number of employees, and qualifying wages.

Your ERC Experts

Solutions to Often Asked Questions

The ERC is a refundable tax credit designed to provide financial relief to businesses that retained employees during the COVID-19 pandemic.

Eligibility criteria include experiencing a significant decline in gross receipts or having operations fully or partially suspended due to government orders.

The credit amount varies based on eligible wages and the size of the business. It can be up to 70% of qualified wages paid to employees.

We partner with a diverse range of companies spanning various industries, from startups to established enterprises. Our collaborations encompass technology firms, financial institutions, healthcare providers, retail businesses, and more.

Documentation may include payroll records, financial statements, and evidence of business operations or government orders.

Yes, for the 2020 tax year, the deadline is April 15, 2024, and for the 2021 tax year, it's April 15, 2025.

Fractional CFO services are valuable for businesses of all sizes, particularly startups, small and medium-sized enterprises (SMEs), and companies experiencing rapid growth or undergoing significant financial changes. They provide flexible financial expertise tailored to the specific needs of each business.

The average Net Promoter Score (NPS) for accounting firms is 30%. At Accu Tax, 90% of our clients express willingness to recommend our services to others.

Our Customer Advocacy Rating measures how likely our clients are to recommend our services, with an exceptional 99% expressing willingness to refer us.

Our services consistently earn five-star reviews from satisfied clients, reflecting our commitment to excellence and customer satisfaction. These glowing testimonials are a testament to the quality

Experience the quality and excellence our clients rave about with our 5-star reviews. Consistently rated top-notch, our services receive glowing testimonials, reflecting our dedication to exceeding expectations. These reviews are a testament to our commitment to excellence and customer satisfaction.

Repeat Business Rate" refers to the percentage of customers who return to make additional purchases or engage in further transactions with a business. It measures the loyalty and satisfaction of customers.

Repeat Business Rate" quantifies the percentage of customers who return to make additional purchases or engage in further transactions with a business. It serves as a key indicator of customer loyalty and satisfaction, reflecting the effectiveness of a company's products, services, and customer experience. By tracking this metric.

Find Your Unexpected Standout CPA

Find Your Unexpected Standout CPA" suggests the idea of

discovering a CPA who surpasses expectations and

stands out among others in terms of skill, expertise, and service

quality. This phrase emphasizes the

potential for finding a

hidden gem or standout professional when searching for a CPA.

Locations

Find us in multiple convenient locations near you, offering expert tax assistance and personalized financial services. Visit us today!

Choose a LocationEngage with a personable & seasoned CPA who will collaborate with you to attain exceptional outcomes.

Keep in Touch

Subscribe to our newsletter to stay informed about the latest updates impacting your business and tax affairs!

Business Solutions

About

Accu ax Stable

Personal Solutions

© 2024 Accu Tax CPAs.All Rights Reserved