Small Business Financial Management

Small Business Financial Management involves the comprehensive oversight and optimization of a company's financial affairs, including budgeting, expense tracking, invoicing, and financial reporting. It aims to ensure the effective allocation of resources and sustainable growth for the business.

Indicators of High-Quality Bookkeeping

Indicators of High-Quality Bookkeeping encompass accuracy, timeliness, and thoroughness in financial record-keeping. It involves meticulous attention to detail, adherence to accounting standards, and the ability to generate clear and insightful financial reports for informed decision-making.

We have some insights on "What Superior Bookkeeping Looks Like" that we invite you to explore!

Did you know?

0%

Approximately half of small businesses cease operations within their initial five years, primarily attributed to inadequate financial management practices during their establishment period.

0%

Seventy percent of businesses that collapse as a result of subpar financial management rely on internal bookkeeping and accounting processes.

0%

Companies that opt to outsource their bookkeeping witness a 40% decrease in operational expenses and a 4% boost in profitability.

Bookkeeping Services

Bookkeeping FAQs

Bookkeeping involves recording and organizing financial transactions of a business. It's crucial for maintaining accurate financial records, tracking income and expenses, and ensuring compliance with tax regulations.

It's recommended to update your books regularly, ideally on a monthly basis. This ensures that your financial records are up-to-date and gives you a clear picture of your business's financial health.

While some small business owners choose to handle their own bookkeeping, hiring a professional can save you time and ensure accuracy. Professional bookkeepers have the expertise to properly categorize transactions, reconcile accounts, and generate financial reports.

Outsourcing bookkeeping can lead to cost savings, increased accuracy, and access to expertise. It allows you to focus on core business activities while ensuring that your financial records are maintained accurately and efficiently.

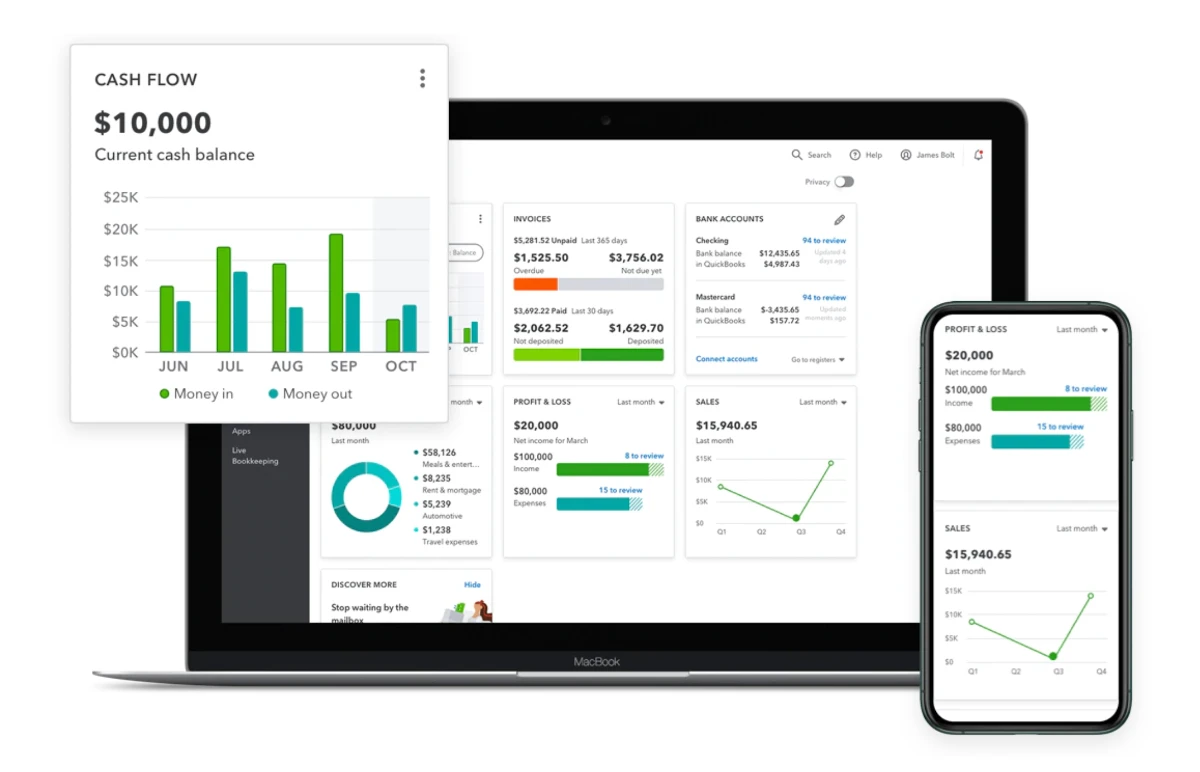

When selecting bookkeeping software, consider factors such as ease of use, features, scalability, and compatibility with your existing systems. Popular options include QuickBooks, Xero, FreshBooks, and Wave.

Essential documents for bookkeeping include sales receipts, invoices, bank statements, expense receipts, and payroll records. It's important to retain these documents for tax purposes and financial reporting.

Implementing efficient bookkeeping processes, such as setting up separate business accounts, maintaining proper documentation, and reconciling accounts regularly, can help streamline your bookkeeping tasks and keep your records organized.

The cost of bookkeeping services can vary depending on factors such as the complexity of your business finances, the volume of transactions, and the level of service required. Generally, bookkeeping services can range from a few hundred to several thousand dollars per month. It's best to consult with a bookkeeping provider to get a tailored quote based on your specific needs.

Sectors We Support

Our supported sectors cover a diverse range of industries, ensuring

tailored assistance

to meet the unique needs of businesses

across various fields.

Find Your Unexpected Standout CPA

Find Your Unexpected Standout CPA" suggests the idea of

discovering a CPA who surpasses expectations and

stands out among others in terms of skill, expertise, and service

quality. This phrase emphasizes the

potential for finding a

hidden gem or standout professional when searching for a CPA.

Locations

Find us in multiple convenient locations near you, offering expert tax assistance and personalized financial services. Visit us today!

Choose a LocationBlogging and Podcasting

Blogging and Podcasting" refer to two popular forms of content creation and dissemination on the internet. Blogging involves writing and publishing articles, posts, or entries on a website, while podcasting involves creating and sharing audio recordings, typically in episodic series. Both mediums serve as effective platforms for sharing information, ideas, and stories with an audience, catering to different preferences and consumption habits.

"Register below to receive essential updates and insights that impact both your business operations and personal financial well-being."

BLOG

Accutax CPA Collaborates with Gusto to Boost Firm Revenue Twofold

VLOG

Accutax Family Affairs

PODCAST

What Actions to Take Regarding the 45% Capital Gains Tax Rate

Engage with a personable & seasoned CPA who will collaborate with you to attain exceptional outcomes.

Keep in Touch

Subscribe to our newsletter to stay informed about the latest updates impacting your business and tax affairs!

Business Solutions

About

Accu ax Stable

Personal Solutions

© 2024 Accu Tax CPAs.All Rights Reserved